In the United Kingdom, the impact of climate change is becoming increasingly evident, with flooding statistics in the UK revealing a pressing concern.

In the aftermath of two extreme subsequent storms, the nation grapples with the economic and environmental costs of flooding which affect homeowners and businesses, the rich and the poor alike.

This article delves into specific statistics and figures related to flooding impacts, shedding light on the challenges and consequences the UK faces, so keep reading to find out more.

UK and EU Flooding Statistics

Considering the recent devastation by Storm Ciaran and increasing future risks triggered by climate change, the outlook on the yearly financial damage across European countries could seem more promising.

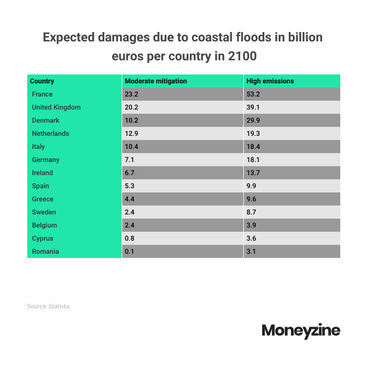

According to verified projections for European countries in 2100, Western countries will suffer the most significant damage under both mitigated and worst-case scenarios.

France tops the list facing the highest annual coastal flood damage at 23.2 billion euros, followed closely by the United Kingdom at 20.2 billion euros under a mitigated scenario.

However, the worst-case scenario of high emissions paints an even grimmer picture. France and the United Kingdom are still the most vulnerable, with annual damage rising to 53.2 and 39.1 billion euros, respectively.

The high emission scenario also puts Denmark, the Netherlands and Italy under a tremendous financial burden, while the least affected countries will be Belgium, Cyprus, and Romania, each facing under 4 billion euros of water damage repair costs in both scenarios.

For a more detailed overview, the table below summarises the expected damages due to coastal floods in billion euros per country in 2100:

Flooding in the UK — Statistics and Facts

Catastrophic flooding is a grave concern for the UK and ranks high in the government's National Risk Register.

Global warming is a crucial contributor to flood and rainfall events nationwide. Scientists claim autumn and winter storms are even more damaging because of intense rainfall and higher sea levels.

Since they are natural disasters, floods are typically not covered by homeowner insurance, so a good idea is to buy disaster insurance to cover the flood insurance cost in the UK.

Considering its geographical position, here are the main types of flooding affecting the country:

River flooding

Surface (or flash) flooding

Coastal flooding

Sewage flooding

Groundwater flooding

Let’s look at the main impacts of flooding, who’s at risk, and what is the financial damage.

UK’s average water damage repair costs presently amount to £1.1 billion annually for coastal erosion only.

Forecasts predict that coastal defence expenditures will increase 3-9 times by the beginning of the 2080s. The worst-case scenario projects an annual average of £126 million in costs, significantly less than the present figure.

Erosion will pose the greatest risk for areas of the east coast and near large estuaries. Beach tourism in Wales and other similar areas of the UK is likely to suffer great financial losses due to coastal flooding.

Cumbria is at the highest risk from flash floods, while coastal floods are most likely in Cornwall.

High-risk areas affected by flooding in the UK are numerous, and many factors contribute to the already grim situation.

Here’s a comprehensive list of UK regions categorised by the main flood risk types:

Flash floods: Cumbria, Merseyside, Buckinghamshire, Wiltshire, Lincoln, Gainsborough, Boothby Graffoe, Lincolnshire.

Coastal: Cornwall, the east coast region, and coastal areas of Kent and Sussex

River: Essex, Kent, Cambridgeshire, Norfolk, Sussex, Somerset, Yorkshire

One in six properties in England faces the threat of flooding.

Surprisingly, floods are more probable than burglaries in UK homes, as UK flooding statistics reveal the number of properties at risk of flooding is approximately 5.2 million.

Of that, 2.4 million properties face the risk of river and coastal flooding, one million of which may also suffer surface water flooding. Additionally, surface water flooding may affect around 2.8 million properties.

26% of businesses are likely to be flooded.

Compared to 14% of all UK properties under threat, this percentage implies that homeowners are less affected than business owners.

An unsettling number of 249.956 businesses are at risk of flash floods in the UK, while 123.800 might face river flooding. Less severe but worrying nonetheless, 19.320 business owners might be affected by coastal flooding.

Topping the list by 32%, retailers bear the highest flooding risk, followed closely by industrial properties at 21%.

Office spaces and utilities are under moderate risk, at 11% and 10%, respectively, while transport facilities and hotels are the least vulnerable, each with a 3% share.

The average cost of flood insurance for homes within 150 metres of water is £208 per year.

The cost of your flood insurance depends on whether you live in a high-risk area, i.e., close to water.

Those living 150 to 400 metres away from a water body will pay £180, while the insurance for properties located further than 400 metres costs an average of £157 per year.

52% of small companies located on floodplains don’t have flood insurance.

Flood insurance cost in the UK can amount to over £40 billion per year. While the damages can reach up to £50,000, most insurance policies cover only a portion of the costs, so it’s no wonder over 75,000 small companies in high-risk areas pass up on flood insurance.

Meanwhile, 60% of business owners exposed to moderate or high risk have trouble affording an insurance cover.

The flooding of 2019/2020 resulted in £333 million in economic losses.

Moreover, the damage would reach £2.1 billion without flood defence measures.

The most devastating floods in the UK in the last 10 years occurred in 2015/2016 when the total flood losses were estimated at an astonishing £1.6 billion.

As for recent devastations, Storm Babet is forecasted to cost the insurance market between £450 and £650 million, enhanced by the still non-quantifiable losses caused by Storm Ciaran.

The Average annual rainfall in the UK increased by 4.2% in the past decade.

Flooding statistics in the UK report significant variations in average rainfall during the past decade, with extreme episodes such as the winter flooding in northern England in 2015/16, which broke all previous records for the area.

That said, 2010 saw a low annual rainfall average of 1,020 millimetres, followed by an immediate surge to 1,889 millimetres the following year. Average rainfall was also high in 2015 and 2020 but remained moderate at 1,320 millimetres in 2022.

A year-on-year overview of average rainfall in the UK in the past decade is in the graph below:

.png)

Agricultural land is forecasted to be flooded at least every three years.

Projections for the decade of 2020 estimate that floods in the UK will damage nearly 35,000 hectares of high-end agricultural land once in three years. This area will expand to 130,000 hectares by the decade of the 2080's.

Floods have a 60% rate as the leading cause of weather-related migrations.

Yet another sound reason for homeowners to look into flood insurance. Additional causes of migrations are storms and wildfires, both of which cause a significantly smaller displacement rate.

The number of people affected by river and coastal flooding across the UK could reach almost 3.6 million by 2080.

Flooding in urban areas due to short-term events affects around 200,000 people today, but this number may increase to between 700,000 and 900,000.

These numbers will be affected by flood management policies and economic development.

The graph below summarises the projected increase in the number of people in the UK at flood risk by decade:

.png)

Conclusion

The UK has been facing challenges with flooding, influenced by climate change and geographic factors for decades.

Due to recent extreme flooding in the UK, statistics predict major economic losses and adverse impacts on the population and the environment in the near future.

With continuous improvements and adaptations in flood prevention and management, there are numerous efforts to protect the still vulnerable nation and the economy.

Keeping track of the latest data and staying prepared on the national level will play a vital role in minimising the impact of future flood events and protecting communities.

.png)

.jpg)

.jpg)

.jpg)

.jpg)