Looking to send money to France but worried about high fees and slow service? We take a close look at what really matters: fees, exchange rates, and how fast your money gets there.

Find out the cheapest and fastest ways to get your money to France in 2025.

We break down the good and the bad of each option, from big names to new players, making sure you see the whole picture. And the best part? We're all about finding you a service that's easy on your wallet and quick to deliver your cash.

Top Money Transfer Providers to Send Money to France

Wise, formerly known as TransferWise, is the service we recommend if you need to send money to France online.

Let's talk about why it's the go-to choice for many. Firstly, when dealing with money, everyone looks for a fair deal, right? That's where Wise shines with its competitive exchange rates.

It sticks to the mid-market rates, ensuring you're not losing out on your hard-earned cash due to inflated exchange rates that banks often use.

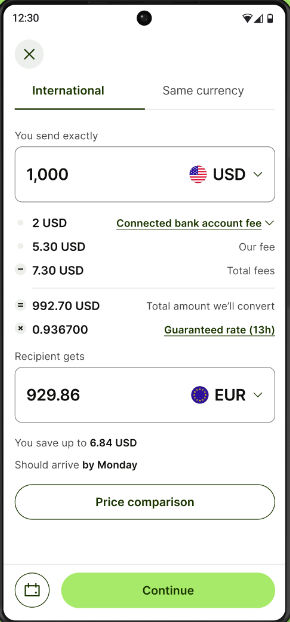

Now, about those pesky fees that seem to sneak up on you with other services – Wise keeps it transparent and low.

For instance, sending £1,000 over to France from the United Kingdom? You're only looking at a fee of £4.49, which honestly is a small price to pay for the peace of mind and efficiency it offers. Plus, the recipient ends up with €1,165.82 in their French bank account, which is a pretty sweet deal.

Speed and reliability are next on the list. Imagine having a same day transfer always available at a small fee. And with real-time tracking, you're not left wondering where your money is floating around.

You can use Wise on your computer or phone. As we point out in the section about apps and mobile payments, the Wise app is considered to be the gold standard in the international money transfer industry.

With advantages like great rates, low fees, quick transfers, ease of use, and solid security. Wise proves itself as the best way to transfer money to France in 2024.

Pros

- Completely transparent on rates and fees

- You can use Wise to make large transfers

- Same-day transfers with real-time tracking

Cons

- It's not quite as cheap as Atlantic Money

- Larger transfers could require additional verification

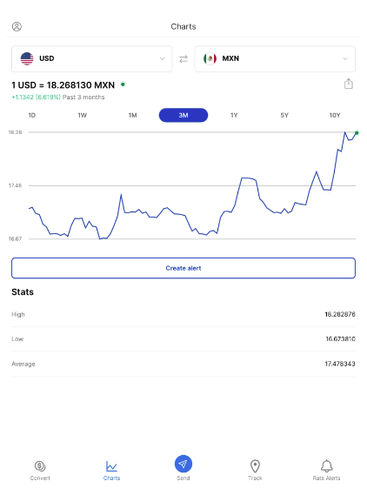

When it comes to finding the fastest international money transfer service in 2024, Xe enters the picture as a standout choice.

This provider specialises in near-instant online money transfers and will get your funds to the destination in no time.

Xe prides itself on the ability to move money swiftly. Transfers in many popular routes (including France) are completed in less than 24 hours, and it's not uncommon for transactions to be done in real-time or just a few minutes. This efficiency is crucial. It's for anyone who needs to ensure funds arrive on time without any problems.

Delivery time aside, another convenient aspect of using Xe is the variety of payment methods you have available. You can pay via bank account, debit card, or credit card, making the process smooth and accommodating to your preferred method.

Pros

- Transfers can be as fast as a few minutes

- Choose from a range of payment methods

- It's easy to set up rate alerts and track transfers

Cons

- There's a markup to the midmarket rate

- Refunds could be quicker

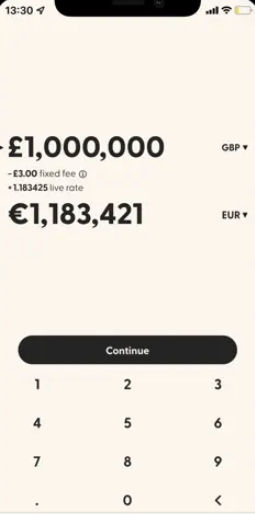

If you are afraid of hidden fees and saving money is your top priority, have a look at Atlantic Money. Of all the payment services we’ve looked at, this is the one that offers the best value and the lowest transfer fees.

Their approach to fees is refreshingly simple – a flat £3 for any transfer you make. This is a big deal when you consider the percentage-based charges or sliding scales that other services might hit you with.

Comparing Atlantic Money to other popular alternatives like Western Union or PayPal will make you wonder why anyone would still use them to transfer money to their loved ones or pay for goods and services.

To make things even more interesting, Atlantic Money uses live interbank exchange rates. This means you're getting the real, unmarked-up rate that banks use to trade among themselves. It's about as close as you can get to the "wholesale" price of currency, ensuring you're not losing out on the exchange.

Cost savings with Atlantic Money are significant. You might be sending small amounts. Or, you might be considering moving up to £1 million at once. The flat fee structure plus top-notch exchange rates can lead to serious savings.

Atlantic Money is under the watchful eye of the Financial Conduct Authority in England and Wales and the National Bank of Belgium. This means their payments are regulated and all their operations are always in check.

Pros

- High limits of up to £1 million

- Very low fees and no exchange rate markup

- FCA-authorised and safeguarding

Cons

- You can only send money by bank transfer

- Your transfer could take a few days

How to Send Money to France Using a Money Transfer Provider

Stop that bank transfer. If you need to send money to France (or any other countries), you better look into relying on a specialised service. If you're gearing up for your first money transfer, follow these three easy steps and your money will be in France today.

Step 1: Compare Providers

Step 2: Sign Up

Step 3: Transfer Money

Save Time: The Fastest Way to Send Money to France

Xe stands out as our top pick for sending money quickly to France. On average, their transfers complete within 24 hours. However, if you need to send money from the UK to France, you may have it reach its destination in seconds.

Xe offers a variety of payment options, including bank accounts, debit, and credit cards, making it easy and flexible for users to pay. You can handle transactions online, over the phone, or via an app. This adds convenience, so you can manage transfers on the go.

Save Money: The Cheapest Way to Send Money to France

Here at Moneyzine, we are all about getting more bang for your buck, and that’s why we loved how cheap Atlantic Money is when it comes to international money transfers.

They've set the bar high with a £3 flat fee for any transfer. This is a game changer compared to percentage-based fees elsewhere. And, they are committed to using live interbank exchange rates. This means you get the best deal without any hidden markups.

The promise of large savings over competitors like Wise, PayPal, or Revolut speaks volumes. Plus, the ability to send up to £1 million in a single go offers unmatched flexibility for both small and large transactions.

Atlantic Money uses local electronic transfers in Europe, including France. This not only cuts costs but also simplifies the process. They recently expanded into key European markets. This move underscores their commitment to providing value-focused services. Furthermore, being regulated by top financial authorities ensures trust and compliance.

What Are the Best Apps to Send Money to France

Wise, Atlantic Money, and Xe all have great mobile apps, so you can take these companies with you wherever you are.

Wise is all about transparency and low costs, showing you the fees upfront and offering real-time exchange rates. Their app is user-friendly, ensuring you can send money quickly and securely.

Atlantic Money grabs attention with its simple £3 fee for any amount. Its app makes the process seamless, from setup to transfer.

Xe's app is a powerhouse for those needing fast transfers. It offers many payment options and can track your money in real-time. Each app brings something unique. They focus on simplicity, cost efficiency, and speed. They prove that managing international transfers from your smartphone has never been easier.

Transfer Safety

In France, the Autorité de Contrôle Prudentiel et de Résolution (ACPR), under the Banque de France's umbrella, oversees all financial institutions. This regulation guarantees that your chosen service follows strict security standards. In short, they make sure your money is safe.

Bank transfers with strangers carry risks, particularly regarding scams or fraud. Thus, using a regulated service or platform offers a layer of protection not always present in direct bank transfers.

PayPal, bank transfers, and money transfer services each have safety protocols. But, regulated money transfer services are often the best at balancing security, speed, and cost.

Phishing and other scams are real concerns. Always verify recipient details and be wary of unsolicited requests for money transfers.

Yes, bank transfers can be subject to scams. This shows the importance of using reputable, regulated services. This is true for any financial transaction, especially internationally.

This approach ensures you send money safely and smartly. You use providers watched by authorities like the ACPR in France.

Things to Consider when Sending Money to France

When you're looking to transfer money to France, a bit of preparation can go a long way to ensure a smooth and efficient process. Here are the key factors to bear in mind:

Regulations and Guidelines

France's financial sector is regulated by many key entities. They include the Autorité de Contrôle Prudentiel et de Résolution (ACPR) and the Banque de France. These bodies ensure compliance with anti-money laundering (AML) and counter-terrorist financing (CTF) laws.

The ACPR oversees banking and insurance. It ensures they follow the legal framework to prevent financial crimes.

French banks may inquire about the origin of the funds you're transferring as part of their due diligence. Legitimate sources such as earnings, business income, or inheritance are typically acceptable. You won’t need to worry about banks interfering with the process when you send money to your family or loved ones in France.

Most inquiries are triggered by large transactions or when opening new accounts.

How Much You Are Sending Abroad

France has its regulations regarding the reporting of large financial transactions. If you plan to transfer a lot, you might need more paperwork.

Transparency is key to avoiding cancellations or rejections of large international transfers. Be ready to provide detailed documentation and answers about the purpose of your transfer - especially if you want to send over €10,000.

Costs of an International Money Transfer

When you calculate the cost of the operation, keep these three factors in mind:

1. Transfer Fees: Fixed charges applied by your service provider. Some platforms may offer free transfers up to a certain limit.

2. Exchange Rate Margins: The difference between the market exchange rate and the rate offered to you.

3. Additional Fees: These may be incurred depending on the transfer method (e.g., bank, online, app). Using a credit card to fund transfers often results in higher fees.

To minimize costs, compare providers. Look for those offering competitive exchange rates and low or no transfer fees, such as Wise or TorFX. Opting for bank transfers over credit card payments can also help reduce fees.

Domestic vs. International Fees

Transfers within France or the Eurozone are usually cheaper and faster. This is because there are no currency conversion fees.

Sending Money to France for Business

If you're sending money for business, like paying overseas suppliers, be aware. You may need to report large transactions to tax authorities.

The exact requirements may vary, so consulting with a financial advisor or the service provider can provide clarity.

Payment Type: Gifts

In France, gifts and inheritances are subject to specific tax regulations, which vary based on the relationship between the donor and the recipient, as well as the value of the gift.

Tax-Free Allowances: The tax-free allowance depends on the relationship between the donor and the recipient. For instance:

Gifts to children are allowed a tax-free allowance of €100,000 per parent, every 15 years.

Gifts to spouses or PACS partners are allowed a tax-free allowance of €80,000.

Gifts to siblings have a tax-free allowance of €15,932, while gifts to nephews and nieces have a €7,967 allowance.

There's also a small gift allowance of €31,865 that can be used under certain conditions, such as for the purchase of a first principal residence.

Tax Rates: The tax rates for gifts above these allowances vary significantly, ranging from 5% to 45%, depending on the amount gifted and the relationship to the recipient. The closer the relationship, the more favorable the tax rates.

Reporting Gifts: Gifts must be reported, and taxes, if applicable, should be paid. The responsibility for declaring and paying any gift tax usually falls on the recipient.

Lifetime Gifts: France encourages lifetime gifts as part of estate planning. These gifts are subject to the same allowances and tax rates as inheritances but can be a tax-efficient way to pass on wealth due to the 15-year rule for tax-free allowances.

These regulations are designed to ensure that wealth can be transferred between generations or among family members in a structured way, taking into account the familial relationship and the value of the gift.

The best way to prepare this is by planning everything in advance and possibly seeking professional advice when considering making a gift that could be close to or exceed these thresholds. This will help you optimise tax efficiency and compliance

What Do You Need to Send Money to France

Sending money to France is quite simple when you're familiar with the requirements. Here’s a checklist to ensure a smooth transfer process:

Recipient's Full Name: Make sure this matches their government-issued ID exactly to prevent any delays.

Recipient's Bank Details: For bank transfers within France or from abroad, you'll need the recipient's IBAN (International Bank Account Number) and BIC (Bank Identifier Code). France uses these standard European banking details for both domestic and international transactions.

Amount and Currency: Determine the amount you’re sending and in what currency. While the Euro (EUR) is the currency in France, consider if you need to convert from another currency.

Your Identification: For most transactions, especially online or bank transfers, you'll be required to provide some form of identification.

Purpose of the Transfer: You might be asked about the reason for your transfer. It’s best to be clear and concise.

For larger transactions:

Declaration Forms: Transferring significant amounts may require you to complete additional paperwork for tax or legal purposes, adhering to both French regulations and those of your home country.

Safety Tip: Always verify the recipient's details if you don’t know them personally. This step is crucial to avoid scams and ensure your funds reach the intended party.

What Do You Need to Receive Money in France

To receive international funds in France smoothly, having a local bank account is advantageous. Senders will need:

Your IBAN and BIC: Essential for international transfers if you are getting the funds transferred into your bank account. These codes facilitate the receipt of funds from abroad.

Possibly additional details depending on the sender's bank or transfer service requirements.

For smaller amounts or when using non-bank services like PayPal or MoneyGram:

Service-Specific Account: An account with the chosen service may be necessary.

Confirmation Codes or Transaction IDs: Important for tracking your funds or collecting them.