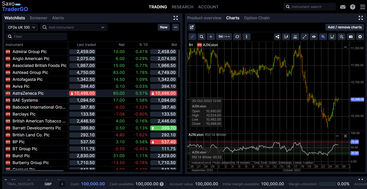

Hargreaves Lansdown and eToro offer UK investors solid platforms with a range of other features of resources include. AJ Bell appeals to those after low fees and user-friendly services, while Interactive Investor stands out for its fixed monthly fee model, ideal for frequent investors looking to save on larger portfolios.

Choosing an investment platform today can feel overwhelming. This is especially true for beginners who don't understand the jargon. Fret not, as we did most of the hard work for you.

We combed through the crowded landscape of investment platforms and narrowed the list down to 11 choices. We also provided you with the most important information and our take on each of them, in simple, understandable terms.

eToro and Freetrade are our top two choices. Find out below what benefits they offer and how they compare to other top investment platforms.

Top Platforms for Investing in the UK

| Name | Score | Visit | Stocks | Account Types | Investing Tools | Disclaimer | |

|---|---|---|---|---|---|---|---|

| 9.1 | Visitinteractivebrokers.com | 11000+ | General, Corporate, Margin, Stocks & Shares ISA, Professional, SIPP, Joint | Investing Courses, Real-time Signals, Practice Portfolio | ||

| 9.8 | Visitplus500 | 2500+ | General | CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 80% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. CFD Service. FCA (FRN 509909). | ||

| 9.0 | Visitxtb.com | 2200+ | General, Professional | Practice Portfolio, Real-time Signals, Investing Courses | CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. | |

| 8.7 | Visitetoro.com | 3000+ | General, Corporate, Professional | Real-time Signals, Practice Portfolio, Investing Courses | eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. | |

| 8.8 | Visithome.saxo | 19000+ | General, Margin, Corporate, Stocks & Shares ISA, Professional, SIPP, Joint | Investing Courses, Practice Portfolio, Real-time Signals | CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage.74% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs, FX or any of our other products work and whether you can afford to take the high risk of losing your money. Losses can exceed deposits on some products. | |

| 6IG | 8.9 | Visitig.com | 15000+ | General, Margin, Corporate, Stocks & Shares ISA, Professional, SIPP, Joint | Investing Courses, Practice Portfolio, Real-time Signals | Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 70% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money. |

| 7.5 | Visitinvestengine.com | 500+ | General, Corporate, Stocks & Shares ISA, Professional, SIPP | Investing Courses | ||

| 7.6 | Visitii.co.uk | 40000+ | General, Corporate, Margin, Stocks & Shares ISA, SIPP, Joint | Investing Courses, Real-time Signals | ||

| 7.6 | Visitfreetrade.io | 6000+ | General, Stocks & Shares ISA, SIPP | Investing Courses, Real-time Signals | The value of your investments can go down as well as up and you may get back less than you invest. | |

| 8.3 | Visithl.co.uk | 8000+ | General, Stocks & Shares ISA, SIPP | Investing Courses, Real-time Signals |

11 Best Investing Platforms in the UK Reviewed

Below, you will find reviews of the top platforms for investing in the UK.

Best UK investing platforms at a glance

eToro - Best investing platform overall

Freetrade - Best for investing on mobile

Interactive Investor - Best for experienced investors

Hargreaves Lansdown - Best for DIY investing

Saxo Markets - Best for large portfolios

Vanguard - Best for long-term investing

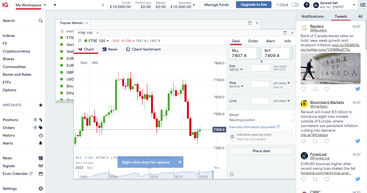

IG - Best for active traders

Trading 212 - Best for keeping costs to a minimum

AJ Bell - Best for retirement planning

Invest Engine - Best for investing in ETFs

Nutmeg - Best for hands-off investing

Pros

- Beginner-friendly and easy to use

- Social and copy trading

- No commission on trading stocks and ETFs

- Nice variety of investment options, including crypto

- Free demo account

Cons

- Withdrawal fees

- Inactivity fees

- No interest on cash balances

- No tax advantage accounts

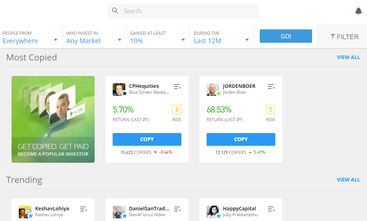

eToro is the most popular social trading platform globally. It has gained popularity for its unique approach to online investing. The platform was established in 2007 and quickly became the number-one choice for millions of traders.

Not only does eToro provide a multi-asset investment platform, but it also allows users to interact with each other. You can even replicate the trades of successful investors. This social trading feature makes eToro an attractive option for many. Beginners can learn from experts and seasoned investors can diversify their portfolios in a user-friendly setting.

eToro is one of the best investment platforms in the UK. It stands out for its affordability, user-friendliness, and access to trading tools and research.

Namely, eToro charges no commission on stock and ETF trading. Its fees for cryptocurrency trading are also pretty competitive. The platform is easy to use both on mobile and desktop and has a robust set of trading tools. Investors can use technical analysis, market research, and real-time data to make informed decisions.

eToro is a fantastic choice for beginners. Its social trading feature helps you learn from experienced investors, and the platform is easy to use. However, be mindful of the lack of tax-advantage accounts and some fees like withdrawals and inactivity charges.

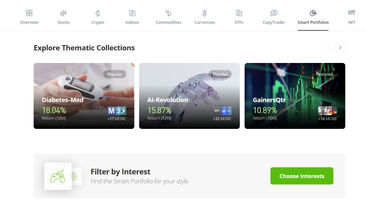

eToro offers a wide array of over 65 smart portfolios of themed investments. These are great for hands-off investors who prefer to leave decisions to experts. In short, the platform successfully caters to multiple types of investors and does it at a reasonable cost.

The one considerable limitation we have to point out about eToro is that it doesn’t provide any tax-advantaged accounts like ISA or SIPP. However, since earlier this year, its users can use the platform to open a stocks and shares ISA with its partner Moneyfarm.

Considering everything, eToro is our top choice for the best investment platform in the UK this year. It has a low cost but still feels like a premium platform. The social and copy trading aspect is a bonus on a platform that is already feature-rich and user-friendly for all types of investors.

Etoro disclaimer: 51% of retail CFD accounts lose money

Pros

- Mobile-first, user-friendly app

- Commission-free trading

- Basic plan with no monthly fee

- Trading of fractional shares

Cons

- Limited research offerings

- No smart portfolio features

- Desktop trading only available for paid plans

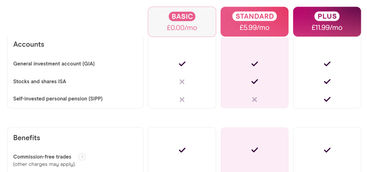

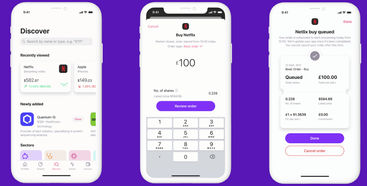

Compared to some of the other leaders in the investing industry on our list, Freetrade is a relatively new online broker. Founded in 2016, the platform has a fresh perspective on online trading and does things a little differently.

Freetrade is a commission-free broker, which means it doesn’t charge anything for the buying and selling of shares. Instead, the platform makes money from its subscription plans and other charges like foreign exchange fees.

Although its basic plan is free, opening an account with tax advantages will require you to move to a premium plan. The paid plans offer more investment options. To create a diverse portfolio, you need to pay the monthly fee.

Even with premium plans, Freetrade only offers access to 6,000 UK, US, and European shares. This is a fraction of what other platforms offer.

Speaking of fractions, one of the standout features of Freetrade is fractional investing. This allows investors to buy fractions of shares they can’t afford. For example, a specific share you are interested in costs £500, but you only have £100 to invest. Using Freetrade, you can buy a fifth of that share.

Another thing worth pointing out is that Freetrade is a mobile-first investment platform. Its mobile app looks and works great, making investing on the go simple and intuitive. The desktop platform is only available in the paid plans, but with the mobile app it has, we don’t believe you would ever need to use it.

While commission-free trading sounds appealing, we must not overlook Freetrade's flat-fee structure. For instance, its monthly fees are less expensive than Interactive Investor's. They can also be much cheaper than the custody fees charged by other brokers.

However, Freetrade's offer lacks investment options, trading, and research tools compared to established platforms. It also doesn’t provide any ready-made investment portfolios, so consider these caveats when making your choice.

Freetrade is perfect for those who want an easy-to-use, mobile-first platform with commission-free trading. However, I do wish it offered more research tools and a wider range of investment options to compete with more established platforms.

Pros

- Excellent variety of investment product offerings

- Flat monthly fee which provides great value for large portfolios

- Award-winning platform

- Pays interest on cash balances

Cons

- No free basic plan

- Costly for smaller portfolios

- High trading costs

Interactive Investor, launched in 1995, is a well-known investment platform. It has won multiple awards and is recognized for its wide range of investment options and fair fees.

Interactive Investor offers a wide range of investment options, with over 40,000 choices worldwide. It's perfect for DIY investors who like to make their own investment decisions. The platform also provides several ready-made portfolios, but the hands-on approach is where it truly excels.

The pricing model has three tiers of platform fees for three portfolio sizes. The plans' affordability can change based on how the investor trades. The monthly fee aims to remove extra fees charged by other brokers. Ultimately, it works out best for investors with larger portfolios.

In terms of trading tools and research, Interactive Investor provides more than enough to meet the needs of most traders. While not the most accessible for beginner investors, the platform can be easy to use once you get the hang of it. We highly recommend it to ambitious beginner investors who want to learn everything about DIY investing.

Unlike eToro, Interactive Investor offers both ISA and SIPP accounts, making it a good option for tax-advantaged investing.

Overall, the Interactive Investor platform is one of the best DIY investment platforms for experienced investors, larger portfolios, or access to the widest range of investment options. But since it does so many things right, it can also be considered a runner-up among the best UK investment platforms.

Interactive Investor is my go-to for building a diverse, DIY portfolio. Its vast range of investment options and flat monthly fee make it great value for larger portfolios, but I’d suggest smaller investors consider whether the high trading costs outweigh the benefits.

Pros

- Massive range of investment options

- Plenty of research and educational resources

- Variety of account types

- No custody fees for holding shares

Cons

- Fund custody fees can become costly

- Very high share dealing charges

- Not ideal for a hands-off approach

Hargreaves Lansdown is the largest mainstream investment platform in the UK. Founded in 1981, the broker has over four decades of experience, more than 1.8 million clients, and over £100 billion of assets under management.

However, does this translate to the best option for you? Well, that depends on what type of investor you are, and what exactly you need from your online broker. And Hargreaves Lansdown has a lot to offer.

Its choice of investment options, asset classes, account types, trading tools, and features is simply massive. For active traders who want to feel in control of their portfolio, the platform provides everything they would ever need, and more. But all of that comes at a cost.

Hargreaves Lansdown is also one of the most expensive investing platforms on the market. And we are not only talking about commissions. Its custody fees can become quite costly, especially for large portfolios. One would argue that premium services always cost more, and they would be right in this case; Hargreaves Lansdown is the epitome of premium service.

It is no wonder that millions of clients chose this broker for their investing needs. The platform feels smooth and professional on both desktop and mobile. It provides tons of research and educational materials, and is one of the few online brokers whose customer service gets praised on review websites online.

But, due to its high costs and pricey fee structure, it is not ideal for everyone. New traders, especially those not using all of Hargreaves Lansdown's services, should seek a cheaper option.

Hargreaves Lansdown offers top-tier service and a vast range of investment options, but the costs can be steep, especially for smaller portfolios. For active traders who can utilise all its features, it's worth it, but beginners might want to consider more cost-effective platforms.

Pros

- A wide range of investment options

- Variety of derivative products

- Great research and plenty of educational materials

- Multiple account types

Cons

- Very complex fee structure with too many fees

- Custody fees for holding stocks, bonds, ETFs, ETCs

- High trading costs

- Expensive for smaller portfolios

Saxo Markets started in 1992. They are a pioneer in fintech and have one of the most advanced online investing and trading platforms in the UK. Saxo Markets, like Hargreaves Lansdown, helps investors create and manage investment strategies, but it's not free.

Saxo Markets focuses on experienced investors and active traders with a DIY approach who know what they want in their portfolios. The platform gives investors access to a huge pool of investment products, including derivatives. It also offers a dozen types of investment accounts so traders can get exactly what they are looking for.

The platform has some of the most advanced, professional-level trading tools and features designed to deliver precision. There are seven ready-made portfolios available on Saxo Markets, which can satisfy several types of risk appetite. However, other brokers can do that for much less.

The biggest drawback of investing with Saxo Markets is undoubtedly affordability. Smaller portfolios, stuck on the Classic plan, would have to spend a fortune on fees and custody charges to use this high-end platform.

On the other hand, nvestors with portfolios over £1,000,000 can enjoy lower percentages and cheaper trading fees. This makes it a better option for them.

Saxo Markets is definitely worth considering for advanced traders who can make the most of its features and investors who can fund their accounts in the VIP tier.

Saxo Markets is an excellent choice for experienced traders who need advanced tools and a wide range of investment options. However, its complex fee structure and high costs make it less suitable for smaller portfolios. If you're new to investing, this might not be the most cost-effective platform

Pros

- No commissions for trading stocks and ETFs

- Plenty of low-cost mutual funds

- Respectable educational resources offering

- Different types of accounts available

Cons

- Mediocre platform with basic features

- Limited research resources

- Minimum deposit requirements

Founded in 1975, Vanguard is one of the pioneers of retail investor accounts. It has revolutionized the way investors approach managing their portfolios. Vanguard's introduction of low-cost index investment funds changed the game, and it hasn’t been the same ever since.

Today, many online investment platforms let almost anyone invest, but Vanguard remains strong against modern rivals. Vanguard remains a low-cost investment platform, and the broker is committed to this. It is one of the most affordable options on the market.

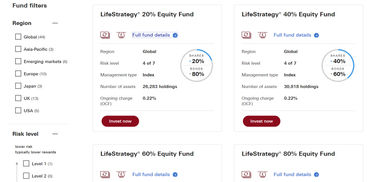

Particularly for trading mutual funds, the platform is arguably the cheapest option out there, but that’s not all Vanguard has to offer. Vanguard provides a robo-advisor service. It also has five ready-made portfolios suitable for different risk appetites.This caters to both active traders, and investors who want a hands-off approach

Even though the platform operates as a commission-free broker, its platform fees are low for portfolios of any size. So, keeping costs to a minimum is the pattern here. Vanguard also has tax-advantaged accounts like SIPP and ISA. This shows their emphasis on buy-and-hold strategies and long-term investing.

In terms of research and trading tools, it is far from the best option, and daily active traders might want to look elsewhere to get what they need. If you want advanced charting tools, technical analysis, and real-time data, there are other options that do a better job.

However, for investors interested in long-term investing, like retirement planning, Vanguard is definitely worth checking out. In addition, it is affordable and simple, making it a good choice for beginner investors. The commission-free structure means they can learn without spending a lot on fees.

Vanguard is perfect for long-term investors and beginners looking for a low-cost, simple platform to grow their portfolios over time. However, if you're a day trader or need advanced research tools, you might want to explore other options with more comprehensive features.

Pros

- User-friendly platform with plenty of features

- Abundance of educational materials and free demo trading account

- Great research offerings and tools

- Discounts for active traders

Cons

- Costly for investors who don’t trade much

- Inactivity fees

- No interest on cash balances

IG is another broker with a history in the investment industry. Founded in 1974, IG stood the test of time and evolved into a global leader in online trading and financial services. Its online investment platform is one of the best in the world and delivers on every front.

IG is user-friendly, yet has plenty of trading tools and advanced features. There's tons of research and educational resources, and it even offers a free demo account for learning the ropes. While beginners may be interested in the offer, IG's platform is best for active traders who can benefit from its discounts.

When used for a buy-and-hold strategy, IG can be costly and far from ideal. But if you make more than three trades per month, it can turn out to be quite affordable.

And there is a lot to trade with IG. The broker gives investors access to more than 13,000 investment products, including complex ones. So it is fair to say that trading, rather than investing, is IG’s bread and butter.

Furthermore, IG provides multiple account types. These include an account for trading spread bets and trading CFDs, which is not something that all brokers have in their offerings. It also gives investors access to ISA and SIPP accounts for tax-advantaged investing.

Unfortunately, IG doesn’t support fractional share trading, which we believe would be an amazing addition to its way of operating.

Our verdict is that IG is truly a great UK investing platform that is certainly worth considering. But it evidently favours trading over investing. Active traders will struggle to find a more suitable broker than IG. Their frequent trading will entitle them to attractive discounts.

Pros

- No commission charges

- Great variety of investment product offerings

- Multi-currency account

- Pays interest on cash balances

- Demo account

Cons

- No ready-made portfolios

- Limited account types

- Research features could be better

- Not ideal for beginners

Trading 212 is relatively new to the UK market, though it is a broker with seriously good offerings. Therfore, it absolutely deserves a spot on our shortlist of the top UK investment platforms this year. Even though it was founded in 2003, Trading 212 only launched in the UK 10 years later in 2013. Since then it has gained recognition because of its low-cost approach.

Namely, Trading 212 is a commission-free broker that doesn’t charge any custody fees. The only costs incurred when trading with this platform are the foreign exchange fees and spreads, and that’s it. It is potentially the cheapest investment platform available in the UK, but don’t let its low costs fool you, this broker has a lot to offer.

Despite the low costs, investors can still find a very respectable selection of investment products at Trading 212. The different asset classes available include futures, options, and commodities. The platform even provides access to an ISA and a CFD account, meeting the needs of several types of investors.

While its research and analysis tools are not on par with some of the more sophisticated platforms on our list, they are good enough for casual investors. Those interested can always try the platform out. It offers a free demo account where they can check its features and practise their trading skills.

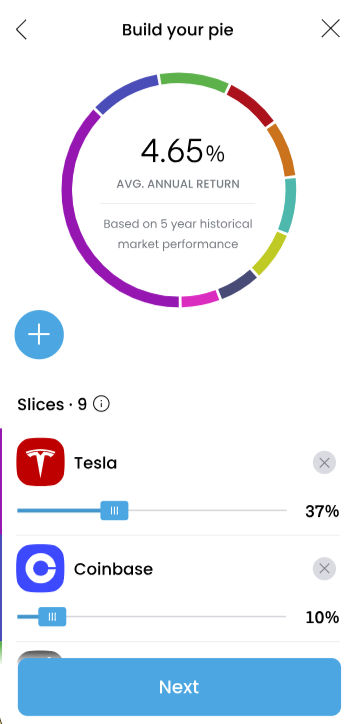

In terms of smart portfolio management, Trading 212 tries to do something different with its Pies & Autoinvest feature. It allows you to quickly rebalance your portfolio. However, it doesn’t work as well as a managed portfolio would, so there are definitely better options if you prefer a hands-off approach.

Overall, Trading 212 is a great platform, more than worth it for its low price. But it isn’t in the same league as some of the household names in the investing industry. It is a perfect match for casual traders who like to keep things simple and costs to a minimum.

Pros

- Award-winning platform

- Fee structure ideal for smaller portfolios

- Plenty of research

- Interest paid on cash balances

- Variety of account types

Cons

- Custody charges on both shares and funds

- Limited investment types

- Lack of educational resources

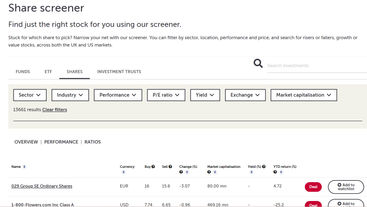

AJ Bell, a traditional investment platform in the UK, has won multiple awards and is highly respected. Founded in 1995, it is an industry leader and an excellent all-rounder when it comes to investing and trading.

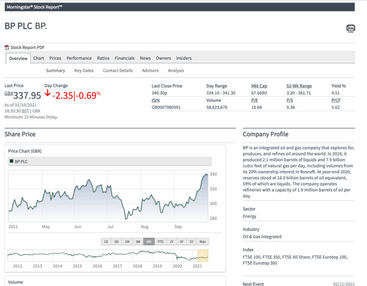

It does many things right. It is one of the lowest-cost options for smaller portfolios. It also has an amazing, user-friendly platform with advanced features and trading tools. Furthermore, AJ Bell provides access to Morningstar research and stock and fund screeners. There are more than 19,000 investment options; making it excellent on multiple fronts.

However, no other broker comes close to AJ Bell when it comes to retirement planning and tax-advantaged accounts. Investors can access a stocks and shares ISA, lifetime ISA, Junior ISA, SIPP, junior SIPP, and a retirement investment account. So it’s safe to name it the best UK investment platform for retirement planning.

Affordability is the main issue when investing with AJ Bell. This is especially true since other brokers offer no-commission trades. In addition to trading fees, AJ Bell also charges custody fees, though they are not that high. However, AJ Bell is pretty affordable for smaller portfolios or buy-and-hold investors.

Traders with large portfolios would probably be better off with a broker who charges a flat fee, rather than AJ Bell’s percentage-based fee. Moreover, if you are looking for complex investment products and derivatives, we suggest you look elsewhere, as AJ Bell doesn’t provide any.

Pros

- Cheapest option for ETF investing

- Fractional trading

- Beginner-friendly and very easy to use

- DIY and managed portfolios

Cons

- Investing only in ETFs and ETCs

- No advanced trading tools or features

- Limited account types

- No interest paid on cash balances

Invest Engine, the newest broker on our list, was released in 2019. Despite its youth, it has gained a reputation for its innovative investing approach. It took advantage of the growing popularity of ETFs by creating a platform that exclusively offers ETF investment services.

Of course, this means Invest Engine isn't ideal for many investors, but the ETF focus has its merits. By concentrating only on ETFs, Invest Engine was able to minimize costs down to a level no other broker could match.

But affordability is not the only thing going for the broker. Its modern and simplistic platform is user-friendly and ideal for beginners. The handpicked selection of more than 570 ETFs can provide diversity. And the fact that it supports fractional trading makes it even more appealing.

Invest Engine also gives investors access to multiple account types, including an ISA. It even gives them the opportunity to create their portfolio by themselves or choose to have it managed by the platform’s team. Unfortunately, Invest Engine doesn’t provide a SIPP at this time, which would perfectly suit its way of operating.

In summary, Invest Engine’s decision to centre its services around ETFs has undoubtedly disrupted the traditional brokerage landscape and provided something new to the scene.

Pros

- Portfolios are fully managed

- Very easy to use

- Plenty of ethical options

- Ideal for hands-off investors

Cons

- No DIY investing

- One of the most expensive brokers

- High minimum deposit

- No variety of account types

Entirely focused on managed portfolios, Nutmeg is a modern investment platform, or what you might call a robo advisor, launched in 2012. It is a platform that makes investing as easy as it gets. With its simplistic smart portfolio management features, it enables even total beginners to create a well-diversified portfolio and meet their personal investment objectives.

To open a Nutmeg account, investors just need to pick their investment style and risk level. The platform will do the rest. Because Nutmeg's management team does most of the work, their platform's charges are higher than DIY investing services.

Nutmeg's fixed allocation portfolios are a more affordable option because they reduce the broker's fee. However, its fully managed portfolios are more expensive. What’s more, unlike most brokers, Nutmeg doesn’t provide any relief for large portfolios or place an upper limit on its custody fees.

If you don't want to learn investment techniques but still want a managed portfolio, choose Nutmeg.

What to Consider When Choosing the Best Investment Platform

When choosing the best investment platform, there are many things to consider. These include costs, asset selection, trading tools, research, and advanced features. The most important thing is to match the investment platform’s offering to your own personal preferences and goals.

Fees and Costs

When choosing an investment platform, it's crucial to fully understand the associated fees and costs, as they can significantly impact your returns and overall investment experience. Even small fees can add up over time, especially with long-term investments or frequent trading. It’s important to evaluate these charges in advance to avoid unexpected costs that could diminish your profits.

Platform fee – The platform fee is a recurring charge that investors pay for using the platform's services. Also known as a subscription, custody, or maintenance fee, this fee generally covers access to the platform, account maintenance, and the use of additional features such as research tools and customer support. Some platforms offer valuable services within this fee, like educational resources and advanced analytics. However, it's vital to check if you’ll actually use these services, as some platforms may charge more than what’s justified by the features provided.

Trading fee – Trading fees are direct costs incurred when executing trades on the platform. These fees can take various forms, including commissions, spreads, or bid-ask spreads. It’s essential to be aware of how these fees are structured because, especially for active traders, they can have a significant impact on profitability. Personally, I’ve experienced how trading fees can add up when trading frequently, which led me to switch to platforms offering more favourable fee structures for frequent trades.

Foreign exchange fee – For those trading international assets or currencies, a foreign exchange (FX) fee may apply. This fee is for converting one currency into another, and the rates can vary greatly between platforms. In my experience, I was surprised by the FX fees when I bought US-listed assets with euros. Since then, I’ve made a habit of checking for competitive FX rates or opting for platforms that offer multicurrency accounts, which can help reduce these costs.

Inactivity fee – An inactivity fee is charged by some brokers if your account remains dormant for a certain period. This fee serves as a penalty for infrequent or inactive trading. I personally encountered this fee during a time when I paused my trading activities. It was an eye-opener and reminded me to check the inactivity policies of any platform I use, ensuring I avoid unnecessary charges when not actively trading.

Spread – The spread is the difference between the buy and sell prices of an asset, and it can vary between platforms. A wide spread means that buying assets becomes more expensive, and selling them becomes less profitable. For example, I’ve found that some platforms, particularly in the crypto space, have larger spreads during periods of high volatility, which can eat into potential profits. It's always important to factor in spreads when considering the true cost of trading on a platform.

Other Fees – Apart from the regular fees mentioned above, there are other specific fees that may apply to particular services or situations. These can include withdrawal fees, fund transfer charges, or fees for premium features. As there are numerous fee structures and charges to consider, it's crucial to carefully review the full fee schedule of any platform before committing. Thorough research will help ensure that you're fully aware of all costs that could impact your investment experience.

How Do Investment Platforms Compare on Fees?

Here’s an at-a-glance comparison of the most important fees associated with the platforms in our review.

Platform (Custody) Fees | Trading Fees | Inactivity Fees | Withdrawal Fees | |

|---|---|---|---|---|

eToro | £0 | £0 | £10 per month | £5 |

Freetrade | £0, £5.99, or £11.99 per month | £0 | £0 | £0 |

Interactive Investor | £4.99, £11.99, or £19.99 per month | £0, £3.99, £5.99, or £9.99 | £0 | £0 |

Hargreaves Lansdown | 0.45%, 0.25%, or 0.1% per year | £11.95, £8.95, or £5.95 | £0 | £0 |

Saxo Markets | 0.12%, or 0.08% + 0.04%, 0.02%, or 0.01% per year | £8, £7, or £5 | £50 per quarter | £0 |

Vanguard | 0.15% capped at £375 per year + 0.20% per year | £0 | £0 | £0 |

IG | £0, or £24 per quarter | £8 or £3 | £12 per month | £0 |

Trading 212 | £0 | £0 | £0 | £0 |

AJ Bell | 0.25% per year capped at £3.50 or £10 per month + 0.25% or 0.10% | £9.95 + £4.95 | £0 | £0 |

Invest Engine | £0, or 0.25% per year | £0 | £0 | £0 |

Nutmeg | 0.75%, 0.45%, 0.35%, or 0.25% per year | £0 | £0 | £0 |

What are the cheapest investment platforms?

According to our research, Trading 212 is potentially the cheapest investment platform in the UK. Additionally, if you are interested in investing in ETFs, Invest Engine also makes a strong case for keeping costs to a minimum.

Fee Structures

Investment platforms are notorious for their often confusing and complex fee structures. Each platform tends to have its own unique way of charging investors, which can make it difficult to compare them directly. Here are some of the most commonly used pricing models in the online brokerage industry:

Flat fee – Also known as a fixed fee, this is a straightforward pricing model where investors pay a predetermined amount for a specific service, regardless of the investment size. For example, you might pay a fixed £5 fee per trade, no matter how much you're investing. In my experience, flat fees can be beneficial for larger investors, as they provide predictability and ease of calculation, without the fees increasing as your portfolio grows.

Percentage-based fee – In this model, the cost is calculated as a percentage of the invested amount. For example, if the fee is 1% and you invest £1,000, the fee would be £10. Percentage-based fees can be advantageous for smaller investors, as the fee increases proportionally with your investment, but is generally lower on smaller amounts. However, I’ve found that this model can eat into profits, especially when investing in high-frequency trades, so it’s important to consider how often you plan to trade.

Tiered fee – The tiered fee structure is a bit more nuanced. Similar to percentage-based fees, it charges investors a percentage of their invested amount, but it offers discounts for larger investments that exceed specific thresholds. For instance, you might pay a 2% fee on the first £1,000, then a 1.5% fee on any additional funds invested above that. I’ve used platforms with this type of structure, and while it can seem attractive for those making larger investments, it’s important to factor in whether you will consistently meet those higher tiers or if the discount is worth the extra complexity.

Generally, flat or fixed fees tend to be the better option for investors with larger portfolios because the costs remain the same regardless of the amount you invest. Tiered or percentage-based fees are often more suitable for smaller portfolios, though this isn't always the case, as certain platforms offer benefits in both structures.

Factors Influencing Affordability

Many factors can influence how affordable a platform ultimately is, and it's not just the fee structure itself. For example, the size of the flat and percentage fees, as well as the tiers available, play a key role. Additionally, some platforms offer perks such as free monthly trades or bonus offers for new investors, which can reduce the overall cost of investing. In my experience, it's also crucial to look out for any hidden fees, such as trading fees or platform maintenance charges, which can significantly impact the total cost of using a particular platform. Therefore, I always advise reading the full fee schedule carefully before committing, as what looks like a low-cost platform can quickly become expensive if these additional charges aren't taken into account.

How much money do you need to start using investing platforms?

The minimum amount required to get started with investing depend on the platform and asset class. With many investing platforms having low or no limits, it is possible to start with only £1. Identifying short and long-term goals, as well as your risk tolerance, may help you judge how much you want to start with. But it largely depends on your personal financial situation. It’s also important to remember that investing is incremental and that a portfolio is built, not made. So every penny counts when putting one together.

Here are some considerations that may help assess your initial investment amount:

Make sure to clear all your debts before investing. By removing any financial drains, you'll have a clearer understanding of how much you can allocate towards investments.

Never invest more than you can afford to lose. While many people may be tempted to invest a large sum of money in search of high returns, investing always carries the risk of capital loss. It's important to ensure your investments do not impact essential expenses such as rent, bills, or food.

Invest regularly. The frequency of investments will vary based on your individual strategy. Investing small amounts regularly can reduce the impact of volatility and promote a disciplined investing approach.

Asset Variety

In addition to costs and charges, different platforms offer diverse types of assets for investment. Their availability on specific platforms plays a significant role in selecting the right one.

Stocks and Shares

Stocks and shares represent ownership in a company. People invest in them by purchasing these shares, essentially becoming partial owners of the company. The primary motivation for investing in stocks and shares is the potential for capital appreciation. In some cases, investors are also enticed by the prospect of receiving dividends.

This asset class offers the benefit of liquidity, meaning you can easily buy or sell shares. However, it also comes with risks, such as market volatility and the potential for loss.

Investing in stocks and shares is suitable for a range of individuals. Those with a higher risk tolerance and a long-term investment horizon find it appealing most often. When investing in stocks and shares, investors need to have some understanding of market dynamics. It's important to do their own research to make informed decisions.

What are the best stock investment platforms?

Some of the best stock investment platforms include Hargreaves Lansdown and Saxo Markets. Investors can use these platforms for a wide range of markets. They offer advanced tools for trading and research, which can aid decision-making.

Funds

Many people like to invest in funds because they can pool their money and invest in diverse assets. There are several types of funds, though mutual funds, ETFs, and index funds are the most popular.

Mutual funds – These are professionally managed investment vehicles. They pool money from multiple investors to buy a diversified portfolio of stocks, bonds, or other securities.

Exchange-traded funds – ETFs are like mutual funds, but they trade on stock exchanges and offer intra-day liquidity.

Index funds – Index funds replicate the performance of a specific market index, such as the FTSE 100 or S&P 500. They provide exposure to a diverse portfolio of stocks.

Investing in mutual funds, ETFs, or index funds offers diversification and professional management. This makes it a convenient option for many. However, investors should be wary of their risks and management fees before deciding to invest in them.

What are the best fund investment platforms?

Many brokers can make a case for being the best fund investment platforms in the UK. Vanguard is the go-to destination for mutual funds thanks to its huge selection. Also, the ETF offerings of Invest Engine are arguably the most affordable options. Meanwhile, Hargreaves Lansdown offers the best index funds and expert investment advice.

Bonds

Bonds are debt securities issued by governments, corporations, or other entities to raise capital. When you invest in bonds, you essentially lend money to the issuer in exchange for periodic interest payments and the return of the principal amount at maturity.

Investors usually invest in bonds to secure a steady stream of interest income. Since they are generally considered less risky than stocks, bonds are considered a safe haven for capital preservation. They can add diversification to a portfolio, reduce its overall risk, and stabilize it during market downturns.

Like any other investment instrument, bonds have their own set of risks as well, including risk of inflation, risk of default, and liquidity risk.

What are the best bonds investment platforms?

There are numerous bonds investment platforms available in the UK, but the ones with the best offerings are Interactive Investor for variety and AJ Bell for its low costs.

REITs

Real Estate Investment Trusts (REITs) are investment vehicles that allow individuals to invest in income-generating real estate properties, without directly owning and managing them. They can be great for adding diversification to a portfolio and securing a stable income. And since REITs can be traded on stock exchanges through property investment platforms, they also provide liquidity.

On the other hand, investing in REITs carries the risk of potential losses due to interest rate sensitivity, real estate market fluctuations, legislative changes, and general market volatility.

What are the best real estate investment platforms?

While there aren’t that many real estate investment platforms, eToro and Freetrade have the best offer for investors who are interested in tapping into the property market.

Cryptocurrencies

Cryptocurrencies are digital or virtual currencies that use cryptography for security and operate on decentralized blockchain technology. Their promise of high returns and the potential to disrupt traditional financial systems is what makes them attractive to many investors.

However, they come with the risks of extreme price volatility and regulatory uncertainties, making them best suited for more experienced investors with a higher risk tolerance and a willingness to navigate a complex and rapidly evolving market.

What are the best crypto investment platforms?

There’s not much strong competition among regulated crypto investment platforms in the UK, making eToro the obvious choice for investors who may want to add cryptocurrencies to their portfolios.

Ethical Investments

Ethical investments, also known as socially responsible investments (SRI), involve investing in companies and funds that align with one's ethical, environmental, or social values. Some investors prefer investing in SRIs as a way to contribute to positive change while potentially earning financial returns.

Since these investments carry a risk of underperformance compared to conventional investments, they are best suited for socially conscious investors who prioritize their values alongside financial returns and have a long-term investment perspective.

What are the best ethical investment platforms?

The best ethical investment platforms with the largest pools of SRIs in the UK include Hargreaves Lansdown and Nutmeg.

Alternative Investments

Alternative investments encompass a diverse range of assets beyond traditional stocks and bonds, including real estate, hedge funds, private equity, and more. Investors who opt for them often do so to diversify their portfolios, seek higher returns, and reduce correlation with the stock market.

The benefits of alternative investments include the potential for enhanced returns and risk mitigation, but their risks involve complexity, illiquidity, and lack of transparency. As such, these investments are most suitable for experienced investors with a higher risk tolerance and a long-term investment horizon.

What are the best alternative investment platforms?

Hargreaves Lansdown and eToro are among the best alternative investment platforms in the UK.

Features and Tools

Features and tools play a pivotal role when selecting an investment platform, as they significantly impact your ability to make informed decisions and manage your investments effectively. These offerings can vary across platforms, but they generally fall into several categories:

Research tools – Investment platforms provide access to research tools like market news, company reports, and analyst recommendations for staying updated and assessing investment potential.

Analysis features – Platforms offer in-depth analysis tools, including fundamental, technical analysis, and risk assessment, to understand financial health and growth prospects.

Charting capabilities – Charting tools visualize price movements, helping identify trends and entry/exit points for investments.

Which platforms have the best features and tools?

If you are looking for a platform with the best, most advanced trading and research tools and features, consider looking into Saxo Market for advanced charting, eToro for innovative sentiment analysis, and Hargreaves Lansdown for news and fundamental insights.

Investment Portfolio Management

Investment platforms offer various options for portfolio management, including:

DIY – Investors make all the investment decisions, select assets, and rebalance their portfolios as needed.

Ready-made portfolios – Or model portfolios, are pre-constructed by financial experts. They are diversified and designed to match specific risk profiles or investment goals.

Robo-advisor – Automated investment platforms that use algorithms to create and manage portfolios based on your risk tolerance and financial goals.

Which platforms are best for portfolio management?

According to our research, eToro is the best platform for DIY, and AJ Bell for ready-made portfolios, while Nutmeg provides the best robo-advisor services.

Stability and Usability

It is crucial for an investment platform to have minimum downtime, as well as to be intuitive and easy to use. The best way to judge a platform’s stability and convenience is to test out all its features through a demo account – this is especially important for beginner investors: a steep learning curve is less than ideal when you start out investing.

Full Functionality Across Devices

The majority of investing platforms now come with both a web workstation and a mobile application. New generation outfits, most notably Trading 212 and eToro, embrace a mobile-first approach and provide a robust mobile product that is fully optimised and features almost every service offered on the web version.

If you prioritise investment portfolio management while on the go, it may be wise to thoroughly test out the mobile product along with the website and monitor the investing app from stores like App Store or Google Play to ensure it receives regular bug fixes and updates.

Regulation and Safety

The Financial Conduct Authority in the UK authorises and regulates any outfit that engages in financial services. As per its regulations, each firm is obliged to segregate the accounts holding client funds from company assets – this means that in the event of the company going insolvent, the client monies are protected, and the company cannot use client monies for their own operational expenses.

Besides regulatory adherence, investors should seek a track record of success, client retention, and a substantial amount of assets under management. It’s also crucial for an investment platform to employ industry-standard security measures like 2-Factor Authentication across all their digital products.

Beware of scams

There are at least 600 unregulated investing platforms available in the UK according to the FCA. Make sure to confirm your preferred platform’s membership with the FCA before using it – you can easily do so.

Head to their home webpage, and scroll down to the footer. Most online investing platforms display an FCA reference number there.

After copying the number, head to the FCA register and enter the details.

There, you can confirm that the online investment platform is registered and that they have updated their details within the last year.

What’s the Financial Services Compensation Scheme?

The Financial Services Compensation Scheme (FSCS) is a UK government-backed safety net that protects investors in case a financial services firm becomes insolvent. All the platforms presented to you in this review are protected by it, meaning their users can receive up to £85,000 in compensation.

Customer Support

Having accessible and informed customer support is significant for all investors, but even more so for beginners. For those who are uncertain about using different products, it's advisable to choose a platform that offers multiple support options, including live chat or phone line. We also recommend testing the support staff by asking several questions to gauge their response time and level of knowledge.

Personal Preferences

Finally, beyond what the platform can offer, the investor’s personal preferences can play a massive role in deciding what platform is best for their investing goals.

Experience Level

Experience level is a crucial factor in choosing the right platform, as beginners may prefer user-friendly options, while experienced investors might seek advanced tools and features.

What are the best investment platforms for beginners?

eToro is the top platform for beginners thanks to its simplicity and copy trading features. Experienced investors, on the other hand, may find Saxo Markets the best option thanks to its algorithmic orders, analysis tools, and other advanced features on the SaxoTrader PRO platform.

Investment Goals and Strategy

Investment goals and strategy should align with the platform, whether it's for long-term growth, day trading, or other specific objectives.

Which platforms are best for long-term and short-term investing?

For example, those who aim to take a long-term, hands-off approach to investing will likely prefer a platform that offers expert-managed funds, such as Hargreaves Lansdown. However, if you’re goal is to develop skills so you can regularly switch between investments based on informed decisions, you’ll want to opt for a platform with educational resources and a low commission, like eToro.

Size of Investment

The size of the investment matters, as some platforms offer fee structures that make more sense for larger investments, while others cater to smaller portfolios with lower fees.

Additionally, some investment types are more suitable for investors with larger capitals, while others can be profitable even with smaller investment amounts.

Here’s a table of recommendations you can consider for your investing needs:

Investment Amount | Investment Type | Best Platform | More Info |

|---|---|---|---|

£5,000 | ETFs | Invest Engine | |

£10,000 | ETFs, stocks and shares, mutual funds | Trading 212 | |

£50,000 | ETFs, stocks and shares, mutual funds, REITs | AJ Bell | |

£100,000 | EFTs, stocks and shares, mutual funds, REITs, bonds | eToro |

Investing Explained

Investing is the process of allocating money to various assets with the expectation of generating a profit or return over time. People invest to grow their wealth, achieve financial goals, and beat inflation.

Individuals can access various financial instruments like stocks, bonds, and mutual funds to build their investment portfolios on investment platforms. The platform provides them with access to markets such as the London Stock Exchange. To start investing, inexperienced investors commonly start by employing simple strategies like Dollar-Cost Averaging (DCA).

This approach involves regularly investing a fixed amount of money, which you can automate on platforms like eToro or Freetrade. Another popular strategy with beginners is opting for portfolios managed by platforms, where professionals handle the investments on their behalf.

Some of the best investments for beginners include diversified index funds, Exchange-Traded Funds (ETFs), and blue-chip stocks.

Investing carries risk

All investments come with a risk of financial loss. Many investor accounts lose money, and high-risk products like CFDs can result in losing money rapidly. It's essential for investors not to use money they can't afford to lose.

Investing vs Trading: What's the Difference?

Both investors and traders purchase securities by participating in the financial markets to make a profit, but they differ in terms of time spent invested and the frequency of placing entry and exit positions. Depending on the strategy, traders usually seek smaller yet more frequent returns by taking advantage of price movements in the short term – like a day, a month, or possibly a year. Investors, on the other hand, focus on long-term gains and hold on to their assets for years or potentially decades.

Should I seek independent financial advice before investing?

Seeking independent financial advice before investing is generally a wise decision to ensure your investment choices align with your financial goals and risk tolerance. Some investment platforms, like Hargreaves Lansdown, offer financial advice services.

How Investment Platforms Work

Investment platforms provide users with a digital interface to buy, sell, and manage investments. Expert-managed platforms involve professional portfolio management, where experts make investment decisions on behalf of users, while DIY platforms give users full control to make their own investment choices.

The key difference is that expert-managed platforms offer hands-off investment management, while DIY platforms require users to make their own investment decisions. Investors also typically pay an annual fee for using expert-managed platforms to cover the management cost, while DIY platforms may charge per trade.

Ways to Use Investment Platforms

There are various ways investors can use investment platforms, including the following.

Automated Investing

This refers to any kind of investing that happens automatically without the input of the user, whether through the use of algorithms, AI, or robo-advisors. This is ideal for those who prefer a hands-off approach. Beginners may opt for robo or AI investing if they don’t want to make their own investment decisions, while algorithmic investing is useful for more experienced investors who have a solid strategy but not enough time to implement it manually.

What are the best automated investing platforms?

Nutmeg is the top platform for robo-investing due to its variety of portfolios. If algorithmic investing is what you’re after, IG is the place to be thanks to its native APIs, off-the-shelf solutions, and tools to build and customise your own algorithms.

Smart Investment Portfolios

Smart portfolios bundle together a variety of assets, typically with a focus on a particular theme or investment goal. They’re ideal for hands-off investors looking for an easy way to gain exposure to particular industries or strategies.

What's the best investment platform for smart portfolios?

eToro is a very popular way to invest in smart portfolios as it offers 65 different options, spanning themes such as gaming, AI, crypto, and diabetes care.

Fractional and Micro-investing

Fractional investing is great for those who don’t want to purchase a whole number of shares. For example, if you wanted to invest in a stock with a price of £500 but you only had £100 available, you’d be able to buy a fifth of a share if your platform allows.

Micro-investment platforms facilitate investing small amounts by offering things such as fractional shares, penny stocks, 0% commission, and low minimum deposits and order sizes. They’re great for those who have limited investment capital or just want to invest their spare change.

What's the best micro-investing platform?

Freetrade is among the best micro-investing platforms as it is a commission-free platform with no minimum deposit and a trade minimum of just £2. You’ll also find a broad range of penny stocks and fractional shares.

Social and Copy Investing

Platforms that offer copy investing enable users to select other investors to copy. Whenever someone you copy places a trade, the same trade will automatically be placed in your account as well. This is perfect for investors who want to reap the same benefits as more experienced investors.

What's the best social investing platform?

eToro is the number-one platform as it has a huge range of investors to copy, useful stats to help you choose between them, and social investing features such as discussions and commenting.

Dividend Investing

This strategy involves buying stocks that pay regular dividends, providing a steady income stream. Dividend-paying companies may be on a strong financial footing, and adding them to a portfolio can provide more stability, though they may not be the best stocks for growth.

Dividends are typically distributed in cash every month, quarter, or year. Your investment platform will likely add any dividends you receive to your account cash balance, where you can reinvest them if you wish. There are also dividend funds that bundle together a variety of stocks that pay dividends.

What's the best dividend investing platform?

Interactive Investor is our top choice for dividend investing as it provides access to a wide range of dividend funds.

Trading

Many investment platforms also support trading. This involves buying and selling assets on a much shorter time scale than investing in order to profit from short-term price fluctuations. Trading typically carries more risk than investing so is better suited to more experienced users who have the time to take a hands-on approach.

The best trading platforms will offer advanced charts with features for technical analysis. They may also enable traders to speculate on the price of assets without actually owning them by trading derivative instruments such as CFDs.

What's the best trading platform?

IG is a great investment platform for those who also want to engage in trading as it offers spread bets and CFDs, multiple advanced trading platforms, signals, alerts, APIs, and algorithms.

Demo and Practice Accounts

A demo account typically looks the same as the real version of the platform with all the same features, but it is funded with virtual money. This is ideal for users who want to get familiar with platform features or test out new strategies before risking any real money.

What's the best demo trading platform?

eToro offers a great practice account as it is very easy to switch between your virtual and real portfolios, and the features are exactly the same.

Types of Accounts on Investment Platforms

Additionally, there are multiple types of retail investor accounts you can use for different purposes.

General Investment Accounts

A General Investment Account (GIA) is a versatile financial product that allows individuals to invest in a wide range of assets, such as stocks, bonds, and funds, without the tax advantages of ISAs or pensions.

GIAs are ideal for investors who have maximized their tax-advantaged accounts or want more flexibility. You can buy and sell investments at any time, making them highly liquid.

ISAs

Individual Savings Accounts (ISAs) are tax-advantaged accounts designed to help people save and invest. There are several types of ISAs, each with distinct features:

Stocks & Shares ISA – This ISA allows individuals to invest in a wide range of assets, including stocks, bonds, and funds, with all gains and income being tax-free. Discover the best stocks and shares ISAs.

Lifetime ISA (LISA) – LISA is geared toward first-time homebuyers and retirement savers. It offers a 25% government bonus on contributions, up to a certain limit, which can significantly boost savings for these goals. You can only withdraw money from your LISA when you reach 60 or buy your first home, otherwise you’ll pay a withdrawal charge. Find out which are the best LISA providers.

Junior ISA – These are for children under 18, and they come in two varieties: Cash Junior ISAs and Stocks & Shares Junior ISAs. Parents or guardians can save on behalf of their children, and the money grows tax-free until the child turns 18. Here are the top Junior stocks and shares ISAs.

ISAs provide a tax-efficient way to save and invest, and they're well-suited for a variety of financial goals. Any returns generated within the ISA are not subject to capital gains tax or income tax, but contributions are subject to an annual limit. You can only save up to £20,000 in total across all your ISAs, and a maximum of £4,000 of this can be paid into your LISA.

What's the best investment platform for ISAs?

Vanguard is a great platform for ISAs due to its variety of managed and DIY options.

SIPPs and Personal Pensions

A Self-Invested Personal Pension (SIPP) and a personal pension are retirement savings vehicles available in the UK.

A SIPP is a type of personal pension that offers more control over your investments. With a SIPP, you can choose from a wide range of investment options, including stocks, bonds, funds, and commercial property. They also offer tax benefits like tax relief on contributions and tax-free growth within the pension.

Personal pensions are more straightforward and are typically managed by a pension provider. They are ideal for those who prefer a more hands-off approach to retirement savings. Personal pensions also offer tax benefits, including tax relief on contributions.

While SIPPs are well-suited for individuals who are experienced investors and want to actively manage their retirement savings, personal pensions are better suited for those who prefer a simplified approach to retirement planning.

What's the best investment platform for SIPPs?

AJ Bell is our top platform for retirement saving as it offers a broad range of options and informational resources.

How to Invest Using Investment Platforms

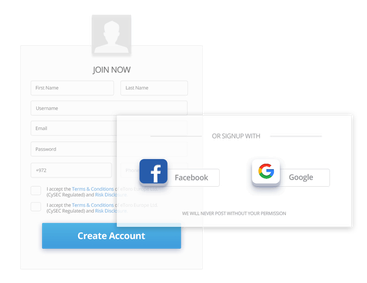

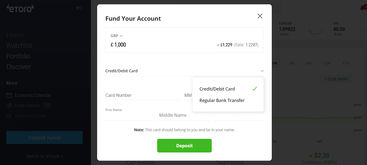

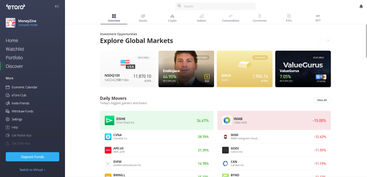

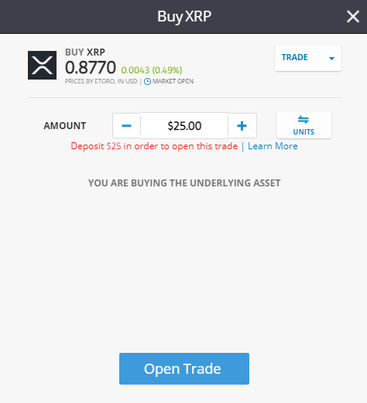

Here’s a step-by-step guide you can use to create an account and invest with any investment platform. In our example, we will use eToro, but most platforms use a similar procedure.

Step 1: Sign Up for eToro

Step 2: Verify Your Account

Step 3: Deposit Funds

Step 4: Search for an Investment

Step 5: Invest

Should You Use an Investment Platform?

Whether or not you will use an investment platform for your investing needs is entirely up to you. The choice is yours, and all we can do is provide you with enough research to help you make an informed decision.

As for our top recommendation, eToro stands out as a comprehensive investment platform. It excels in social trading, allowing you to follow and copy the strategies of experienced investors. This feature can be particularly beneficial if you're new to investing, as it provides a learning opportunity.

Additionally, eToro's intuitive interface makes it accessible, even for beginners. These factors, along with competitive fees, contribute to our recommendation of eToro as a great choice for those considering an investment platform.

It's important to note that if investment platforms don't align with your goals and preferences, there are alternative options available. Consider investment apps, trading platforms, or savingif investment platforms aren’t for you.

Investment Platforms FAQs

Can I invest on different platforms?

Are investment platforms safe?

What should you avoid when investing?

Are there fee-free investment or share dealing platforms?

What's the cheapest online investment platform in the UK?

What is the biggest investment platform in the UK by size?

How much money should a beginner invest using investment platforms?

What is the best way to invest small amounts of money in the UK?

Conclusion

When selecting the best investment platform, it’s essential to evaluate your individual needs, goals, and experience. Beginners should look for platforms with easy-to-use interfaces, educational resources, and low fees. More experienced investors may prioritise advanced tools, a wide range of investment options, and low-cost trading fees. Additionally, consider features like social trading, automated investing, or retirement planning, depending on your preferences.

After considering all factors, I recommend eToro as a great starting point for new and intermediate investors. Its user-friendly interface, no-commission stock and ETF trading, and social trading features make it an ideal platform for those wanting to learn and interact with others. The ability to copy successful traders allows beginners to gain insights into the strategies of more experienced investors, while the platform’s wide range of investment options ensures that you can diversify your portfolio as you grow. Additionally, eToro’s free demo account makes it easy to practice without financial risk, which is perfect for those just beginning their investment journey.